Sellers may want to make it clear in writing that they won’t be participating in making repairs or providing credit allowances. Most sales agreements include as-is provisions & inspection clauses that may already be pre-printed. It’s important to carefully address your desire to sell as-is without eliminating the buyer’s rights to any written representations. State required Property Disclosures or Federally mandated lead disclosures, in the case of pre-1978 homes, are required. Whether or not a Buyer fully inspects the property or waives that right is something both parties should cautiously approach. It would serve the Sellers’ best interests to allow any potential Buyer the opportunity to fully inspect their property.

In the event, a Buyer chooses to waive that right it should be in writing. Waivers should be based upon the buyer knowingly and voluntarily electing to waive that right. Private parties should seek legal counsel when preparing a sales agreement. Licensed Brokers should avoid altering any pre-printed language to suit Sellers’ wishes to drive home a point without first consulting legal counsel. It’s easier to simply stay within your lane and not make changes to legal terminology already in place.

It’s not always a clear path despite one party or another laying the ground rules. As-is means different things to different people. It’s not uncommon for a Buyer who discovers a “big-ticket item” to take pause. Sewer lines & underground fuel tanks are often met with “I didn’t mean to include that in my as-is offer”. Of course, the Seller is not obligated to change the terms & conditions as originally agreed to. On the other hand, not coming to an agreement may mean the sale won’t close. Sellers should consider their potential liability for dealing with certain issues, despite any previous no repairs stance.

In the case of an abandoned underground fuel tank, there is no statute of limitations. I’ve had this conversation with many Buyers & Sellers over the years and there is plenty of potential liability to go around for passing along this issue. In Oregon, a DEQ (Department of Environmental Quality) Certified contractor is required to report leakage within 48 hours. Sellers must take responsibility but, what about a situation where both parties agree to sell without further testing? The Seller may feel it’s the Buyers’ responsibility going forward. What if the Buyer were to lose the house to foreclosure and disappear? With no statute of limitations, the Government can bypass owners to the next in line, the Seller. The Government will pull out all the stops to locate past owners. Banks who foreclosure are exempt & can sell without the tank being decommissioned thus, truly as-is.

There are lessor issues dollar-wise that a Seller should also consider despite any previous ‘no repair’ stances. Where CO & Smoke alarms are required saying I won’t do it or simply handing them over and saying “You do it” is short-sighted. If that potential buyer simply didn’t get around to installing them and is injured or perishes in a fire there is something to be said for that Sellers’s liability. Even a somewhat minor issue could have negative ramifications down the road thus, counsel from your Broker should always be sought before simply saying no.

In a recent condo sale, we were advised that a dryer duct had dislodged from the roof vent. It may have subsequently contributed to the fungi growth on the sheathing. Ducting from the interior space had been accidentally cut, that too may have been a contributing factor. Might the Association consider the latter as a contributing factor to their fungi issue? Despite the duct being within the Association’s domain consideration was given to simply replacing the entire duct.

In a hot market, Buyers will oftentimes want their offer to stand out. In order to stand out, some will opt to waive their inspection rights. It’s important they’re not given the impression or feel compelled to do so by the Seller or their Broker. As the cost of repairs & maintenance takes their toll Buyers may second guess waiving an inspection. In a Real Estate transaction, all things must be in writing but, they’re only as good as the parties involved. Good verbal communication along with the appropriate written language will protect both parties’ interests.

Bob Zawaski P.C., G.R.I.

Oregon Licensed Principal Broker

Investors Trust Realty

Once the market analysis is completed, listing signed & post sign is set in the ground the real work begins. Putting the market plan into action is now priority one. Discussing how to react when things don’t go as planned is equally important as the initial plans themselves. Sellers may not be receptive to talk of any upfront failure and Brokers will be treading lightly as well. It’s important that an honest dialogue take place up front in order to keep things in proper prospective.

Once the market analysis is completed, listing signed & post sign is set in the ground the real work begins. Putting the market plan into action is now priority one. Discussing how to react when things don’t go as planned is equally important as the initial plans themselves. Sellers may not be receptive to talk of any upfront failure and Brokers will be treading lightly as well. It’s important that an honest dialogue take place up front in order to keep things in proper prospective.

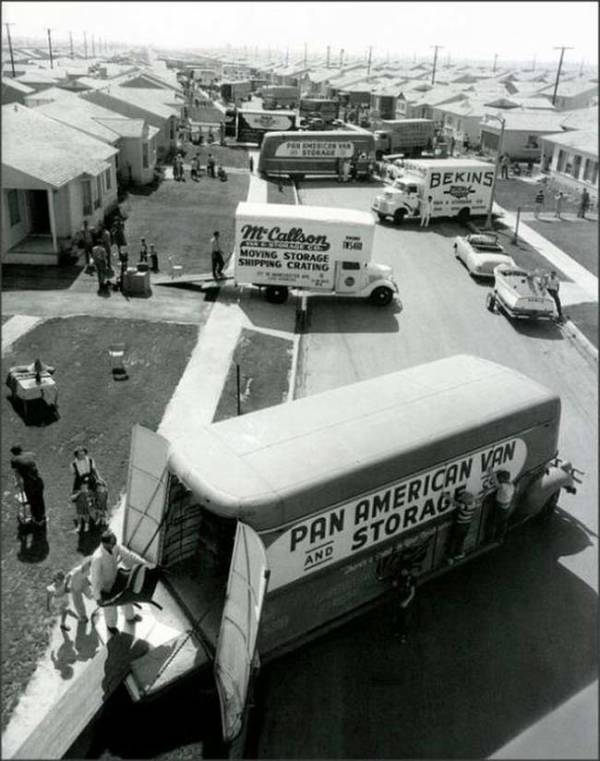

When one thinks of the term conversion as it’s used in Real Estate, one of the first thoughts that may come to mind is that of converting multifamily apartments to condos. As prices continued to appreciate during the years prior to 2007, there were numerous conversions that yielded far better returns ‘by the piece’ then as a ‘whole part’. When values soon thereafter began their rapid downward descent many of those property owners were faced with making mortgage payments on a property whose value was far less than what they now owed and/or paying monthly Homeowners Association dues. The combination of weakened buyers coupled with fractured Associations is just one of several components that have contributed to home ownership being at it’s lowest level since 1995. As a result of decreased home ownership (64.8% in 2014) the rental market has seen increased rents throughout most of it’s segments. In the Portland, OR metro area rents have increased by 5% in the last 6 months with Downtown rents typically going for $1.82 per sq. ft. & NW Portland rents spiking to $1.61 per sq. ft..

When one thinks of the term conversion as it’s used in Real Estate, one of the first thoughts that may come to mind is that of converting multifamily apartments to condos. As prices continued to appreciate during the years prior to 2007, there were numerous conversions that yielded far better returns ‘by the piece’ then as a ‘whole part’. When values soon thereafter began their rapid downward descent many of those property owners were faced with making mortgage payments on a property whose value was far less than what they now owed and/or paying monthly Homeowners Association dues. The combination of weakened buyers coupled with fractured Associations is just one of several components that have contributed to home ownership being at it’s lowest level since 1995. As a result of decreased home ownership (64.8% in 2014) the rental market has seen increased rents throughout most of it’s segments. In the Portland, OR metro area rents have increased by 5% in the last 6 months with Downtown rents typically going for $1.82 per sq. ft. & NW Portland rents spiking to $1.61 per sq. ft..